Introduction

Managing your Amazon business credit cards can be a difficult task, especially when trying to keep track of expenses and payments. But what if I told you there was a solution that could give you peace of mind and a 100% guarantee?

In this article, we will explore the challenges of managing Amazon business credit cards and introduce a tool that will make your life easier. With this solution, you can say goodbye to worries and focus on growing your business. Read on to find out more!

Benefits of using Amazon business credit cards

Did you know that using Amazon business credit cards can make your business operations much smoother? Check out some awesome benefits you might want to think about:

Increase purchasing power: With a business credit card, you have access to a higher credit limit, enabling you to make larger purchases and invest in your business growth.

Earn rewards: Many Amazon business credit cards offer rewards programs where you can earn points, cash back, or other incentives for every purchase you make. These rewards can be an asset for your business, allowing you to save money or reinvest it back into your projects.

Convenient expense management: Business credit cards make it easy to track and manage your expenses. Most cards provide detailed statements and online tools that allow you to categorize and monitor your spending, making your accounting process easier.

Build credit history: Properly managing your business credit card can help you establish a strong credit history for your company. This can be beneficial when applying for future loans or other forms of financing that are essential for expanding your business.

Next, we are going to talk about important things to think about when choosing the perfect Amazon business credit card for Business.

Types of Amazon business credit cards available

When you’re thinking about Amazon business credit cards, you’ve got lots of choices. Knowing about the various types can help you pick the right one that fits perfectly with what your business needs.

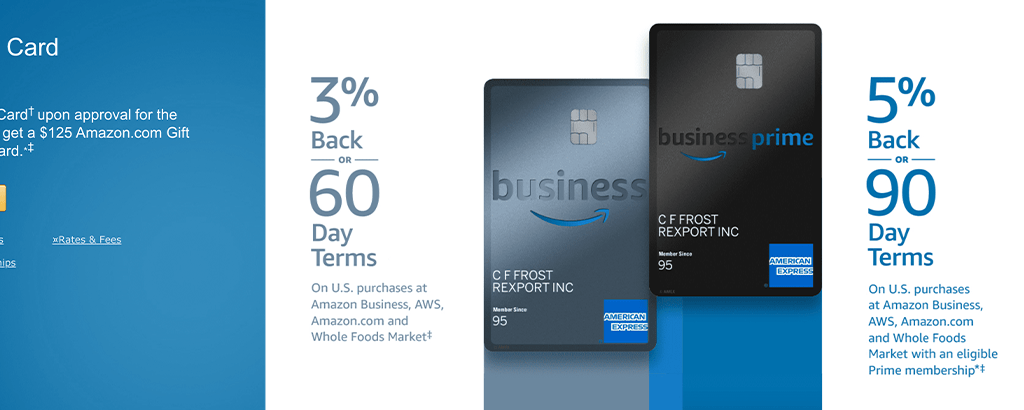

1. Amazon Business Prime American Express Card: This card offers a range of benefits, including 5% back or 90-day terms on eligible purchases at Amazon Business, Amazon.com, AWS, and Whole Foods Market. it offers 2% back at US eating places, US petrol pumps, and US wireless phones that are bought directly from US providers of services.

2. Amazon Business American Express Card: With this card, you can earn 3% back or 60-day terms on eligible purchases at Amazon Business, Amazon.com, AWS, and Whole Foods Market. Additionally, it gives 2% back on approved purchases made at US food services, US petrol pumps, and US wireless phone services that are bought straight from US service providers.

3. Amazon Business Prime American Express Card No Annual Fee: Like the first card, this option offers 5% back or 90-day terms on eligible purchases at Amazon Business, Amazon.com, AWS, and Whole Foods Market. However, it stands out because it has no annual fee.

4. Amazon Business American Express Card No Annual Fee: This card provides 3% back or 60-day terms on eligible purchases at Amazon Business, Amazon.com, AWS, and Whole Foods Market, and 2% back on eligible purchases at U.S. restaurants, US petrol pumps, and US wireless phone services that are bought straight from US service providers. Like the previous option, it also has no annual fee.

Now, we are going to talk about how to apply for an Amazon business credit card and what you’ll need to get it.

How to apply for an Amazon business credit card

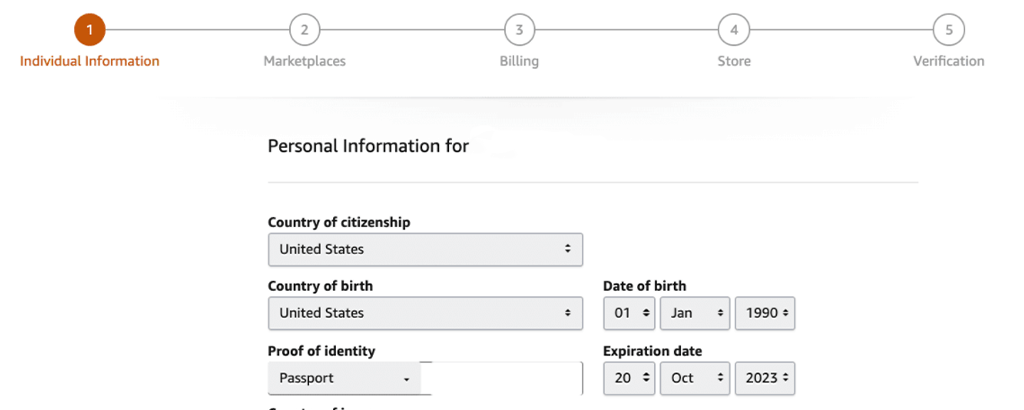

To apply for an Amazon business credit card, you will need to visit the Amazon website and move to the business credit card section. From there, you can select the specific card that aligns with your needs and click on the “Apply Now” button.

You will be directed to a secure application page where you will need to provide your business information, including your business name, address, and contact details. You may also be required to submit some documents, such as your business license or registration.

Once you have completed the application, you will need to wait for a decision from the credit card issuer. This decision is typically made within a few business days, and if approved, you will receive your card in the mail shortly after.

Applying for an Amazon business credit card is a straightforward process that can be done online, providing you with a convenient and efficient way to access the benefits and rewards offered by these cards.

Amazon business credit card fees and interest rates

One important factor to consider when applying for an Amazon business credit card is the fees and interest rates associated with the card. While these costs can vary depending on the specific card you choose, it’s essential to understand them before deciding.

Most Amazon business credit cards have no annual fee, which can be a significant benefit for small businesses looking to save money. However, it’s important to review the terms and conditions of each card to make sure that there are no hidden fees or charges.

Regarding interest rates, it’s important to note that these can vary depending on your financial standing and other factors. It’s always recommended to pay off your balance in full each month to avoid accumulating high-interest charges.

By understanding the fees and interest rates associated with your Amazon business credit card, you can make informed decisions about your spending and make sure that you are getting the most value from your card.

Comparison of Amazon business credit cards with other options

When you’re thinking about getting an Amazon business credit card, it’s important to compare it to other options out there. Even though Amazon has lots of advantages, it’s important to check if there might be better choices that suit your business needs.

Some other credit card options may offer higher cashback percentages or rewards suited to your business’s needs. Additionally, think about the customer service and fraud protection provided by different card issuers.

Additionally, look over the credit limit and spending flexibility offered by each card. Depending on your business requirements, you may need a higher credit limit or the ability to make large purchases without restrictions.

By comparing Amazon business credit cards with other options, you can make sure that you are making the best choice for your business.

Tips for maximizing the benefits of Amazon business credit cards

Now that you have compared Amazon business credit cards with other options, it’s time to make the most out of your choice. Here are some tips to maximize the benefits and rewards offered by Amazon business credit cards:

1. Understand the rewards program: Get to know yourself with the terms and conditions of the rewards program associated with your Amazon business credit card. This will help you understand how to earn and redeem rewards effectively.

2. Choose bonus categories: Take advantage of any bonus categories that offer higher reward rates. For example, some Amazon business credit cards may offer extra rewards for spending on office supplies or advertising. Plan your expenses accordingly to earn more rewards.

3. Sync with Amazon Prime: If your business is already an Amazon Prime member, make sure to link your Amazon business credit card to your Prime account. This can unlock additional benefits and discounts exclusive to Prime members.

4. Pay your balance in full: To avoid unnecessary interest charges, strive to pay your credit card balance in full each month. This will help you to get the most out of your rewards without spending extra money.

5. Keep track of spending: Regularly monitor your credit card statements to keep track of your spending. This will help you identify any unauthorized charges and allow you to analyze your expenses to make informed decisions.

6. Take advantage of special offers: Amazon often runs special promotions and offers for its credit card customers. Keep an eye out for these deals, as they can provide extra benefits such as cashback or discounts on select purchases.

7. Use your rewards strategically: Once you’ve accumulated a significant number of rewards, consider how you can use them to benefit your business. Whether that’s using them to offset future expenses or investing them back into your company, make sure you are using your rewards in a way that aligns with your business goals.

By following these tips, you can make the most of your Amazon business credit card and ensure that you are maximizing the benefits it offers.

Common misconceptions about Amazon business credit cards

Now, we are discussing some common misconceptions about Amazon business credit cards and reject them. It’s important to have accurate information so that you can make informed decisions about your financial tools. Let’s clear up some of the confusion surrounding Amazon business credit cards.

Misconception 1: Amazon business credit cards are only beneficial for large businesses.

Fact: While Amazon business credit cards do offer benefits tailored to businesses of all sizes, they can be valuable tools for small and medium-sized businesses as well. Whether it’s earning rewards on everyday business expenses or accessing special financing options, these credit cards can provide useful advantages for businesses of any scale.

Misconception 2: Amazon business credit cards have high-interest rates.

Fact: Like any credit card, the interest rates on Amazon business credit cards can vary depending on factors such as creditworthiness and market rates. It’s important to review and understand the terms of your specific credit card agreement, including the interest rates and any applicable fees. By paying your balance in full each month, you can avoid accruing interest altogether.

Misconception 3: Applying for an Amazon business credit card will hurt my credit score.

Fact: Applying for any credit card, including an Amazon business credit card, may result in a temporary decrease in your credit score due to the inquiry being recorded on your credit report. But usually, this effect is minor and temporary. If you manage your credit responsibly by making payments on time and keeping your credit utilization low, an Amazon business credit card can help improve your credit score over time.

Misconception 4: Amazon business credit cards have limited acceptance.

Fact: Amazon business credit cards are issued by established financial institutions and are typically backed by major payment networks such as Visa or Mastercard. This means that they can be used wherever these payment networks are accepted, both online and offline. Additionally, as Amazon is a global marketplace, having an Amazon business credit card can provide convenience when making purchases on the platform.

By dispelling these common misconceptions, we hope to provide you with a clearer understanding of the benefits and features of Amazon business credit cards.

Alternatives to Amazon business credit cards

While Amazon business credit cards can offer a range of benefits, it’s important to explore all your options before deciding. There are several alternatives to consider that may better suit your business needs.

FIRST ALTERNATIVE is a traditional business credit card. These cards may offer similar rewards programs and financing options but with potentially lower interest rates and fees. Additionally, they may provide more flexibility in terms of where the card can be used, as they are not limited to the Amazon platform.

ANOTHER OPTION to explore is a business line of credit. This can provide you with the ability to borrow funds as needed, with interest only being charged on the amount you use. This can be a great option if you have variable cash flow or require funds for specific projects or investments.

LASTLY, consider exploring business loans from financial institutions. These loans can provide you with a lump sum of capital that can be used for a variety of purposes, such as purchasing inventory, expanding your business, or covering unexpected expenses. While this option may require a more thorough application process, it can provide you with the financial flexibility and security you need.

Before committing to an Amazon business credit card, take the time to research and compare these alternatives to ensure you are making the best decision for your business.

Conclusion: Making the right choice for your business credit card needs

In conclusion, dealing with those Amazon cards can be kinda tricky, right? But guess what? I’ve got some really easy ways to make it all simpler!

These cards help you buy more stuff, give you cool rewards, and make it easy to watch your money. Picking the right one is super easy, applying is a breeze, and knowing how much it costs is important.

Little tricks can help a lot, and oh, don’t forget, there are other options too! So, be sure to look over all of them before making a decision. Ready to make your business awesome?